By Francis kioko.

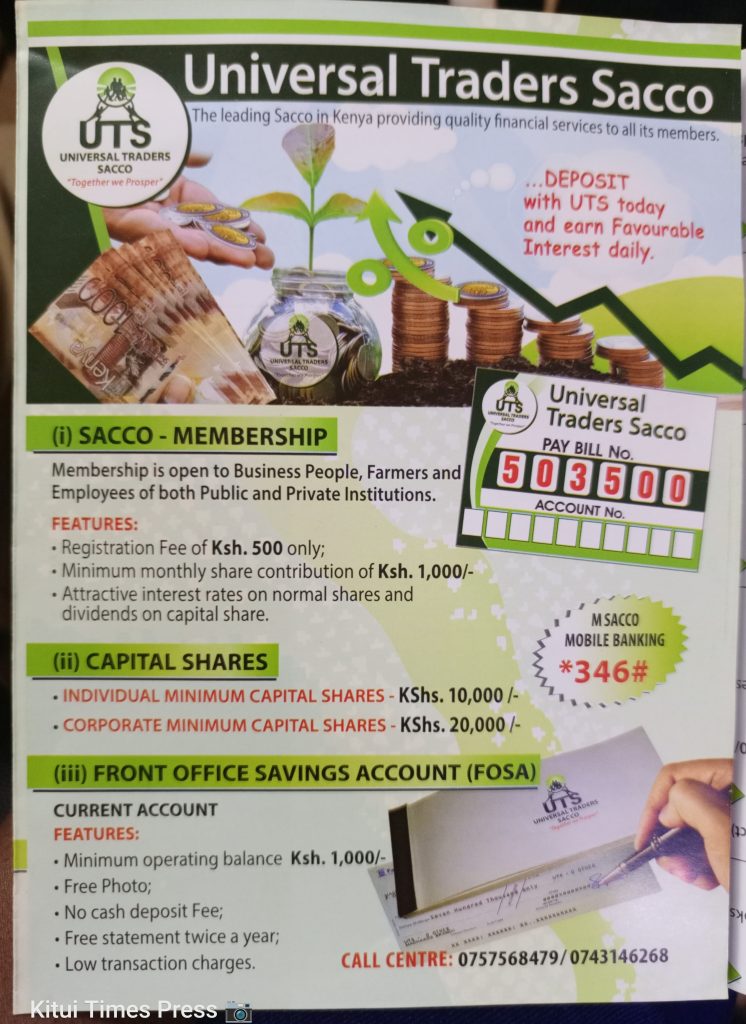

Universal Traders Sacco (UTS) members convened today at the Agricultural Training Centre (ATC) in Kitui Town for a comprehensive education session and the Kitui branch delegates elections. The event, attended by key figures from the Sacco, was marked by the introduction of new financial products and services aimed at empowering women, youth, and general members.

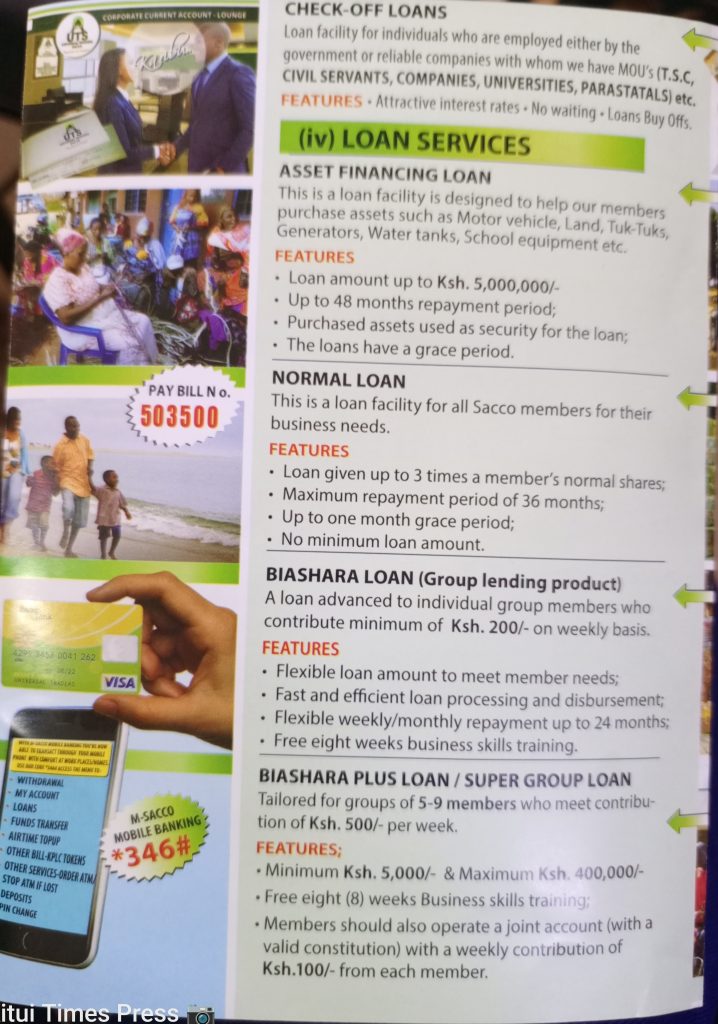

One of the highlights of the meeting was the introduction of new loan products under the Women Enterprise Fund. Women were encouraged to take advantage of these loans, which come with a favorable interest rate of 8%, to support their entrepreneurial ventures and personal growth. The initiative aims to provide financial support to women, helping them achieve economic independence and success.

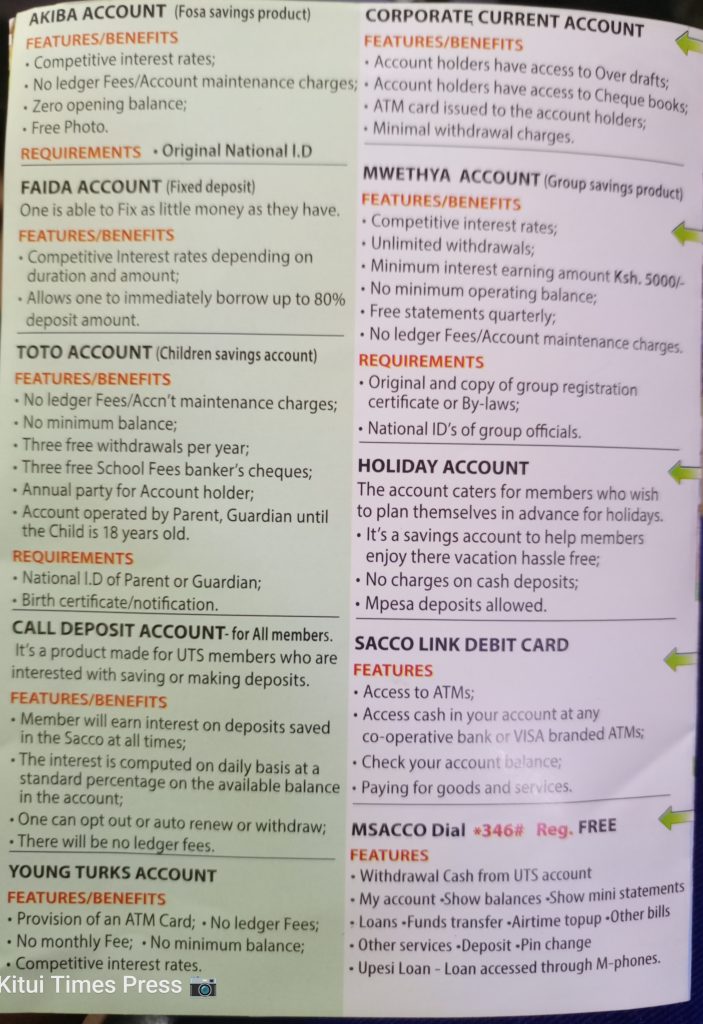

Youth members with UTS accounts were urged to keep their accounts active through regular savings. This, they were told, would not only secure their eligibility for loans but also enable them to empower themselves economically. The emphasis on youth participation underscores UTS’s commitment to fostering a culture of savings and financial responsibility among young people.

The Sacco also announced an increase in the loan limit for the Upesi loan product to Ksh. 50,000. Additionally, members were advised to use the Mpesa paybill service number 503500 connected to their UTS accounts to enhance their credit history. This move is expected to facilitate easier access to credit and better loan management for members.

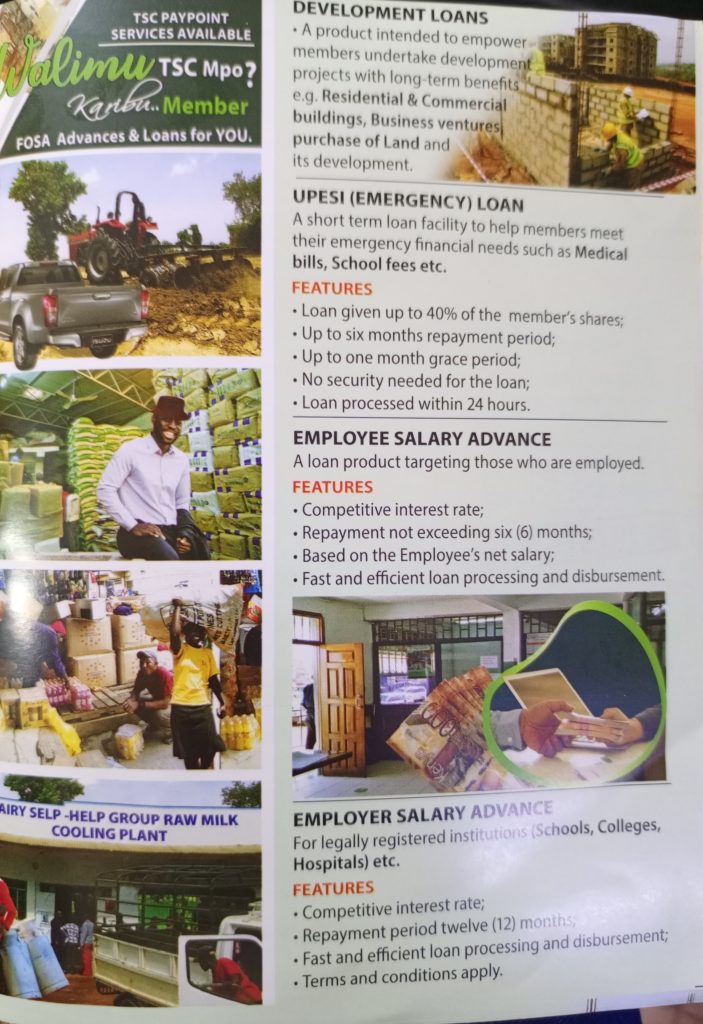

below are some of UTS Loan products

UTS has reintroduced its popular promotion program, starting this month. Members who top up their capital share with Ksh. 10,000 or more will receive a 3% commission quarterly, credited to their Akiba accounts. The promotion will run in two rounds: July to September and October to December, with regular share top-ups earning a 2% commission quarterly. Top performers in this promotion will be recognized as Sacco ambassadors and will receive additional rewards.

Speaking at the event, UTS CEO Dominic Mutunga emphasized the importance of using loans for their intended purposes to avoid setbacks in repayment. He advised members facing income flow issues to communicate with the loan manager to agree on manageable repayment amounts. CEO Mutunga also cautioned against taking loans that exceed one’s repayment capacity to ensure smooth and timely loan settlements.

Several members shared testimonies about how UTS loans had empowered them to become property owners, successful entrepreneurs, and productive farmers. The positive impact of the Sacco’s financial products on members’ lives was evident through these stories.

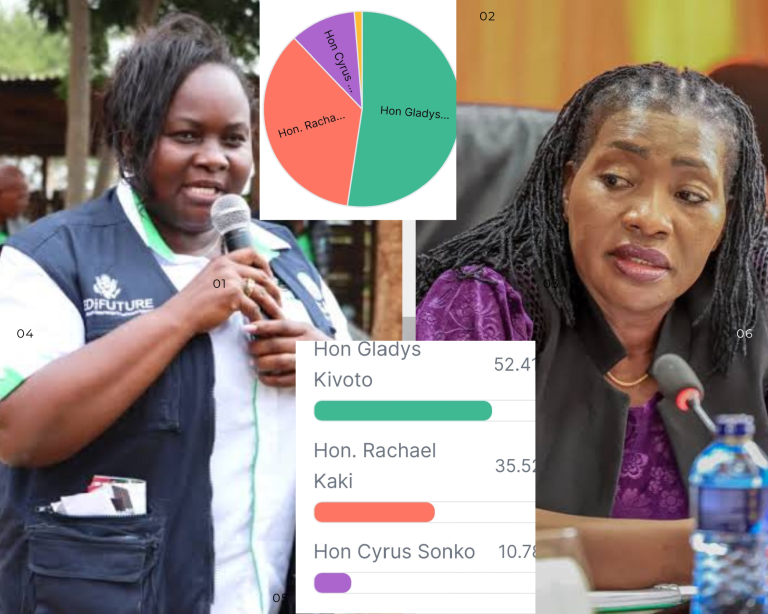

UTS Chairman Fredrick Ngumbi urged members to lead purposeful lives and maintain unity within the Sacco. He concluded the members’ training session by overseeing the Kitui branch delegates elections. Nine new delegates were elected by the Kitui UTS members, signifying a step forward in the branch’s leadership and representation.

The event in Kitui Town was a testament to UTS’s ongoing commitment to member education, financial empowerment, and community development. With the introduction of new loan products, enhanced credit facilities, and exciting promotions, UTS continues to support its members in achieving their financial goals and aspirations.